The rat-a-tat-tat of the woodpecker

I was determined to be ready for him this time! The night before, I removed the screen from the upper window, filled up the power squirt gun and pumped its pressure up. He would not escape a good soaking!

I was determined to be ready for him this time! The night before, I removed the screen from the upper window, filled up the power squirt gun and pumped its pressure up. He would not escape a good soaking!When six am came around this morning, I was again awoken by a rat-a-tat-tat pounding upon the house. I stealthily moved to the window, took up the squirt fun, threw up the window sash and fired point blank at the red head. Being disoriented, and unsure where the stream of water was coming from, he started to fall. But he quickly recovered and flew up to the building next door.

I yelled, "This is my territory - you are not welcome!", as he was shaking his feathers free of water and looking very dejected. He sat there for a few minutes, wondering if he could get another shot at my siding. "Go all ready", I said, followed by a stream of water. He flew off to the Southwest and didn't look back. I later looked him up on the 'net and found that he was a Red-breasted Sapsucker woodpecker, native to the Pacific Northwest. Very territorial and enjoys excavating cavities in fir (which my siding is made up).

But he just reinforced what this summer's working will consist of - my 118 year old fir siding. I should be ready next weekend to start tearing down the architectural details and siding, milling and installing the replacements. I'll be doing just one section of the house at a time.

Anyone else have woodpecker versus house stories to tell?

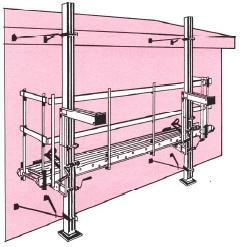

I began setting up the scaffolding this weekend, assembling the first course of a three unit high sctructure, with two sections on each side of the house, and two in front on either side of the front stoop. I was originally just going to put up the two sides, but with all the excess frames I had, I thought I might as well encase the front of the house in a big C shape, adding to the stability of the overall structure.

I began setting up the scaffolding this weekend, assembling the first course of a three unit high sctructure, with two sections on each side of the house, and two in front on either side of the front stoop. I was originally just going to put up the two sides, but with all the excess frames I had, I thought I might as well encase the front of the house in a big C shape, adding to the stability of the overall structure.